Internal Auditing is a critical component of an organization's risk management strategy. It is an independent, objective assurance and consulting activity designed to add value and improve an organization's operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes. Internal Auditing can provide insights into potential risks and opportunities that can affect an organization's success. Internal Auditors are responsible for assessing the adequacy and effectiveness of internal controls, ensuring adherence to laws, regulations and policies, providing assurance on the accuracy of financial statements, evaluating the efficiency and effectiveness of operations, and providing advice on governance matters.

As such, Internal Auditing plays a pivotal role in helping organizations achieve their objectives. In this article, we'll discuss the definition of Internal Auditing, the different roles and responsibilities of Internal Auditors, and how Internal Auditing can help organizations achieve their goals.

Benefits of Internal Audit

Internal audit provides organizations with independent assurance that their financial and operational objectives are being met. It helps organizations identify areas for improvement and reduce costs by providing an objective view on the effectiveness of internal controls, procedures and processes. Internal audit can also help organizations identify fraud and other risks and assess their internal control systems to minimize those risks. Organizations benefit from internal audit by gaining assurance that their internal control systems are working properly and effectively.Internal audit helps organizations identify and mitigate any potential risks related to financial reporting, operational activities, and compliance with applicable laws and regulations. Additionally, internal audit helps companies identify areas for improvement and cost savings opportunities. The benefits of internal audit go beyond providing assurance and identifying potential cost savings. Internal audit also helps organizations build trust with stakeholders, as it provides independent assurance that the organization is managing its operations in a responsible manner.

Purpose of Internal Audit

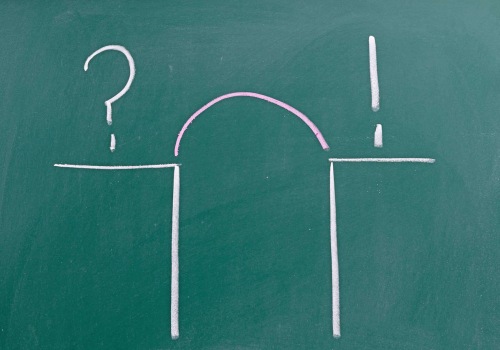

Internal audit is an important part of an organization's internal control system and is responsible for evaluating the effectiveness and efficiency of an organization's financial and operational activities. The purpose of internal audit is to provide independent assurance that the organization's risk management, governance, and internal control processes are operating effectively. It helps to identify risks, reduce errors and fraud, and improve performance. Internal audit can help organizations manage their risks, understand their operations, and make informed decisions.It helps organizations to identify areas where they can enhance their performance, improve the effectiveness of their operations, and increase their overall efficiency. Internal audit also provides assurance that the organization's internal control systems are functioning properly and provides a basis for management to take corrective action when necessary. In addition to providing assurance about the effectiveness of an organization's internal control processes, internal audit also provides recommendations for improvement. By providing an independent evaluation of processes, internal audit can help organizations identify weaknesses in their risk management, governance, and internal control systems that could lead to errors or fraud.

It can also provide guidance on how to address these risks and improve performance.

Process of Internal Audit

Internal audit process The internal audit process typically follows a defined set of steps and procedures. The first step is to identify the scope of the audit, which includes determining what areas or processes will be evaluated. Once the scope is determined, the internal audit team will conduct a risk assessment to identify any areas of potential risk or areas that may need further review and investigation. The team will then develop an audit plan and schedule to ensure that the audit is conducted in a timely and effective manner.The internal audit team will then begin the actual audit process. This involves gathering evidence and documentation, interviewing personnel, and testing processes and procedures. The team will then analyze the evidence to determine if there are any weaknesses or control issues that need to be addressed. Based on the findings, the team will make recommendations to management for corrective action or improvements.

Finally, the team will document their findings in an audit report which will be provided to management. The internal audit team is typically composed of individuals with a variety of skills and experience. In addition to internal auditors, the team may also include staff from other departments such as finance, accounting, operations, or information technology. All members of the team should be knowledgeable about the organization's policies and procedures. The internal audit team works closely with management throughout the process. The team provides guidance and assistance on identifying and addressing risks, while also providing feedback on the effectiveness of existing controls.

The audit team also helps to ensure that any changes or improvements are implemented in a timely manner.

Examples of Internal Auditing

Internal auditing plays an important role in helping organizations identify and address operational, financial, compliance, and other risks. It can involve examining data, processes, and controls, as well as interviewing personnel. Real-world examples of how organizations use internal auditing to identify risks and improve performance include:Case Studies:Case studies are one way to illustrate the value of internal auditing. For example, a study conducted by PricewaterhouseCoopers in 2015 revealed that 80% of companies that implemented an internal audit system experienced improved financial performance.Process Reviews:

Organizations can also use internal auditing to review existing processes and procedures.This can help identify areas of improvement and ensure the organization is operating efficiently and effectively. For example, a retail chain may use internal auditing to review its supply chain management processes to ensure it is achieving the best possible results.

Risk Assessments:

Risk assessments are another key component of internal auditing. These assessments involve identifying and evaluating potential risks to the organization and implementing controls to mitigate those risks.For instance, a manufacturing company may use internal auditing to assess the risk of a supplier failing to meet its contractual obligations.

Controls Testing:

In addition to risk assessments, organizations can use internal audits to test existing controls. This helps ensure that controls are working as intended and that any necessary changes or improvements are made. For example, a bank may use internal auditing to test its anti-money laundering controls to ensure it is in compliance with relevant regulations.Types of Internal Audits

Internal audits are conducted to assess the effectiveness and efficiency of an organization's internal control system.There are several types of audits that can be conducted, including financial, operational, compliance, IT, and fraud audits. Each type of audit is conducted in a different way and provides different information.

Financial Audits

- Financial audits are designed to examine an organization's financial records and ensure that they are accurate and in compliance with relevant laws and regulations. During a financial audit, an auditor will review balance sheets, income statements, and other financial documents to look for inaccuracies or discrepancies. Financial audits can also be used to detect fraud or mismanagement.Operational Audits

- Operational audits are conducted to assess the efficiency of an organization's operations.During an operational audit, an auditor will examine the organization's processes and procedures to ensure that they are efficient and effective. The auditor will also examine the organization's resources to ensure that they are being used in the most efficient manner possible.

Compliance Audits

- Compliance audits are designed to ensure that an organization is in compliance with relevant laws and regulations. During a compliance audit, an auditor will examine the organization's policies and procedures to ensure that they are in accordance with relevant laws and regulations. The auditor will also review documents such as contracts and agreements to ensure that they comply with applicable laws.IT Audits

- IT audits are conducted to assess the security and effectiveness of an organization's IT systems.During an IT audit, an auditor will examine the organization's IT infrastructure to ensure that it is secure and effective. The auditor will also review the organization's policies and procedures to ensure that they meet security standards.

Fraud Audits

- Fraud audits are conducted to detect any fraudulent activities within an organization. During a fraud audit, an auditor will examine financial records and documents to identify any irregularities or discrepancies. The auditor will also investigate any suspicious activities or transactions that may indicate fraud. In conclusion, internal audit is a critical tool for organizations to identify and address risks, improve performance, and reduce costs.The purpose of internal audit is to provide an independent and objective assessment of an organization's financial and operational activities. The process of internal audit involves examining, evaluating, and analyzing organizational operations and financial records. Benefits of internal audit include detecting fraud, increasing efficiency, and providing assurance about internal control systems. There are three types of internal audits: operational audits, compliance audits, and financial statement audits.

Examples of internal auditing include reviewing an organization's procedures, policies, processes, and controls. Internal audit is an essential element of a company's internal control system. It helps organizations proactively identify risks, boost performance, and reduce expenses. This article has outlined the purpose, process, benefits, and types of internal auditing.